Carbon Capture: Early Days of a $1 Trillion Industry?

Key Takeaways

- Carbon capture can help both reduce the carbon footprint of certain industries and, uniquely, remove legacy carbon from the atmosphere; even the most ambitious emission-reduction scenarios maintain a share of fossil fuels usage, suggesting carbon capture solutions are needed to achieve full decarbonisation.

- The business opportunity is significant considering the scalable nature of carbon removal and capture solutions and assuming carbon prices in excess of $100/ton over the next several decades.

- Oil majors, industrial gas companies and a variety of smaller innovators look well positioned to capture share, though achieving scale at competitive economics remains a challenge.

The Need for Carbon Removal

The best way to mitigate climate change is to rapidly transition the energy ecosystem from fossil fuels–based energy to renewable and clean sources. However, this is not yet practical to do everywhere and even the more ambitious decarbonisation scenarios include continued reliance on fossil fuels for decades to come. The United Nations Intergovernmental Panel on Climate Change (IPCC) — the part of the U.N. responsible for advancing knowledge on human-induced climate change — has developed four main future scenarios of CO2 emissions and mitigation to help model evolutions to the economic, energy and land use systems. According to the IPCC, in pathways that limit global warming to 1.5°C, the quantity of CO2 needed to be captured and stored cumulatively this century ranges from 348 Gigatons (Gt) on the low end to over 1,200 Gt on the high end, in all but one scenario, depending on the level of fossil fuel use.1 The world currently emits roughly 37 Gt of CO2 per year, suggesting that as much as 12%–40% of CO2 abatement may need to be achieved via carbon capture (assuming straight lining of emissions) if society’s pace of fossil fuel usage reduction does not meet the more aggressive pathway.

Because of this, complementary solutions such as carbon capture, utilisation and storage in reducing carbon emissions or even going a step further and removing existing CO2 from the atmosphere are necessary. In fact, though the technology is in the early stages, carbon capture is likely being underestimated in its importance and scalability over the next 30 years.

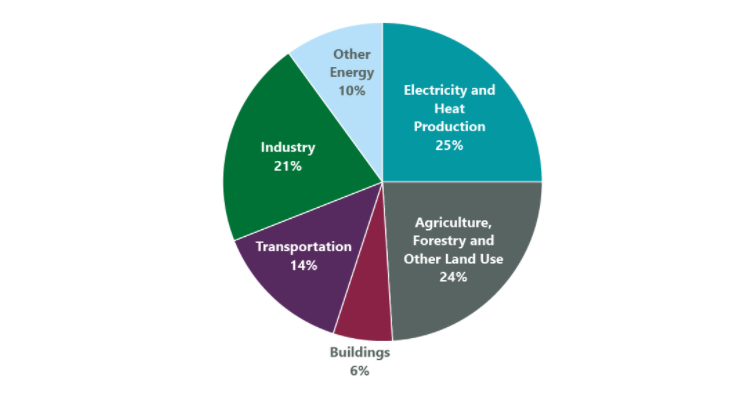

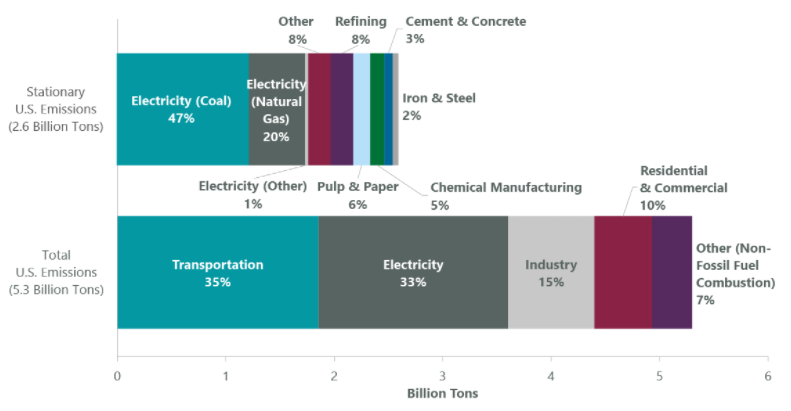

Society emits CO2 mainly when it burns fossil fuels; this occurs in large combustion units, for example in fossil-fuel-sourced electric power plants (stationary sources), and in more dispersed ways, through gas-powered vehicles and furnaces in buildings. Industrial and resource extraction processes also emit greenhouse gasses (GHG). Roughly half of U.S. emissions are from stationary sources which lend themselves to carbon capture (Exhibits 1 and 2).

Exhibit 1: Global Greenhouse Gas Emissions by Economic Sector

Source: IPCC, 2014.

Exhibit 2: U.S. Emissions Overview

As of 2017. Source: U.S. EPA, Inventory of U.S. Greenhouse Gas Emissions and Sinks: 1990–2017.

Carbon capture is most efficiently applied to large point sources such as cement and concrete manufacturers, power plants and large industrial processes, although the technology is also applicable in other ways. Carbon capture looks to collect and concentrate the CO2 produced in power plants and large industrial processes and transport it to a storage location — mostly underground — where it can be stored for a long time.2

Another carbon capture approach, direct air capture (DAC), seeks to remove CO2 emissions directly from the atmosphere (see also below). DAC has the benefit of being able to be placed anywhere in the world where geological storage is available and can be scaled to capture increasing amounts of carbon, both offsetting existing emissions and potentially rolling back the clock on legacy emissions. In 2020 the World Resources Institute posited that DAC could “plausibly remove nearly one and a half billion tons of carbon dioxide per year by 2050 — equivalent to taking around 300 million cars off the road for a year — if the technology can deploy as quickly as solar photovoltaic (PV) has and if we start in the next few years.”3

Carbon capture’s ability to enable the continued use of fossil fuels makes it somewhat controversial. Yet even the most ambitious sustainability scenarios have coal and gas in the power mix for decades to come. As mentioned above, most scenarios from the IPCC have carbon capture as a factor in the carbon reduction framework. The capital stock of coal plants in India and China is still young and will be with us for some time — in fact, well over 100 coal power plants are under construction in China today. In addition, cement production and parts of agriculture will remain CO2 intensive — all of which highlights the need to capture and remove or use CO2.

A $1 Trillion Industry in the Making?

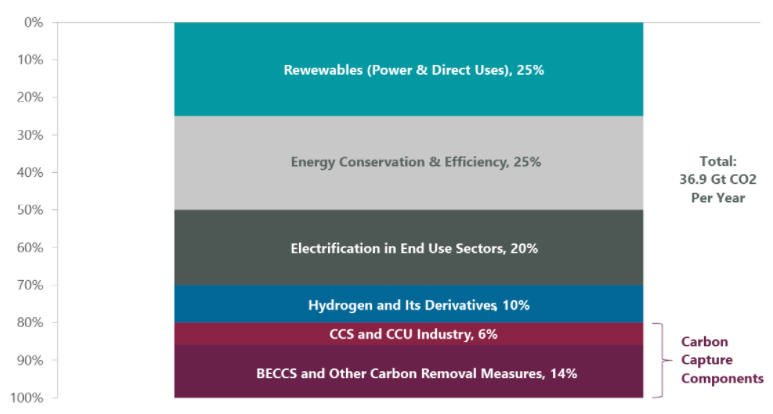

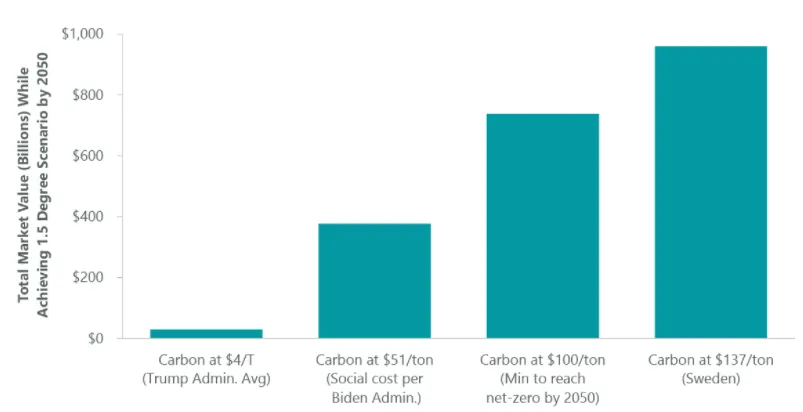

A big task will mean a large market opportunity. Some sort of carbon capture is involved in roughly 20% of the abatements needed to reach the 1.5°C scenario per the International Renewable Energy Agency (IRENA) as shown in Exhibit 3. This translates to the removal of 7.38 Gt of CO2 per year (7,380,000,000 tons), which, depending on the price of carbon (the amount charged to emitters in order to incentivise reductions), translates to substantial revenues for the future carbon capture industry (Exhibit 4). To put carbon prices in context, Sweden has the world’s highest national carbon tax at $137/ton as of April 2021, yet emissions there since 2012 have dropped only 8%, far short of the Paris Agreement goals. This suggests carbon prices may need to increase meaningfully. Assuming $137/ton, a 1.5° scenario implies the carbon capture industry could reach a $1 trillion total addressable market.

The scalability and the need for major capital investment in the sector, combined with existing equity investments in carbon capture, explains the oil majors’ interest in this market. Theoretically, there is considerable revenue potential for companies developing carbon capture projects. As an example, Exxon Mobil accounts for 2.3% of the global crude market. If it can achieve similar share of global carbon abatement, with a carbon price of $137 per ton, and $1 trillion of total addressable market abatement value, abatement revenues would amount to $23 billion per year.

Exhibit 3: Abatements in Energy Transition Strategy

Source: IRENA, World Energy Transitions Outlook: 1.5°C Pathway, 2021.

Exhibit 4: Sizing the Carbon Capture Market Opportunity

Source: ClearBridge Investments, IRENA, Scientific American. Assuming 7.38 Gt CO2 of carbon captured per year. https://www.scientificamerican.com/article/cost-of-carbon-pollution-pegged-at-51-a-ton/

Methods of Carbon Capture: A Breakdown

The term carbon capture refers to several related technologies aimed at preventing the emission of greenhouse gases into, or even removing existing molecules from, the atmosphere. First, how is carbon captured? At stationary sources such as power generation and steel and cement production facilities, carbon may be separated either pre-combustion or post-combustion (before or after the burning of coal, oil or natural gas), or by oxy-fuel combustion (using oxygen in a process that makes CO2 and water, from which the CO2 is removed). Once separated, it can be transported by pipeline and either stored underground or reused in industry.

Today, only 27 operational carbon capture projects exist globally with 13 in the U.S., capturing a small fraction of CO2 emissions.4 This will need to grow to hundreds or even thousands of facilities globally. From a total of 40 million tons (Mt) CO2 captured in 2020, the world will need to achieve 1,670 Mt CO2 by 2030 and 7,600 Mt CO2 by 2050 in the International Energy Agency’s (IEA) estimates as part of carbon capture’s contribution to bringing energy-related CO2 emissions to net-zero by 2050.5

Carbon capture and storage or sequestration (CCS) treats CO2 as a waste product and buries it underground in saline aquifers, which are deep geological formations of water-permeable rock saturated with salt water, or brine or in old oil and gas reservoirs. Deep saline aquifers exist across the world and have considerable storage capacity, sufficient to store emissions from large stationary CO2 sources for at least a century.6 CO2 can also react with basalt rock and turn into stone within a few years, thereby permanently storing it.

Carbon capture and utilisation (CCU) pivots after the capture stage and, instead of storing the CO2, seeks to capitalise on the fact that captured carbon can be used in steel, cement, chemicals, as well as fuels and enhanced oil recovery industries. The food industry also uses CO2, for example, in beverages and dry ice to keep transported goods cold. It may be possible to use captured CO2 in lieu of raw fossil fuels to help decarbonise the aviation and other sectors where renewable energy is difficult to use directly.

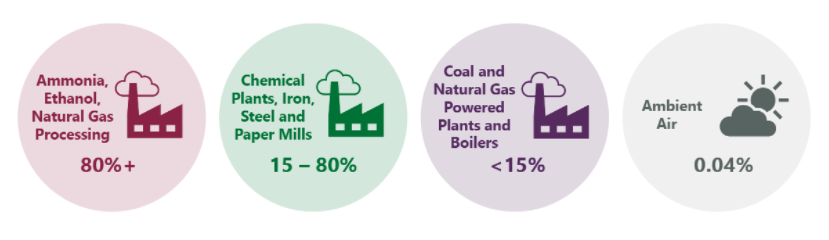

Direct air capture (DAC) aims to remove CO2 from the ambient air, thus reversing historical carbon emissions and accelerating decarbonisation. In direct air capture CO2 is vacuumed out of the atmosphere, after which it can be stored or reused, creating a circular carbon economy. DAC is still early in its development as it faces the issue of capturing CO2 in very low concentration in ambient air of only 0.04% (400 parts per million; Exhibit 5). Yet in principle, DAC is highly scalable and has an advantage of not being attached to any specific source of emissions. The main drawbacks to this approach are the high cost and energy requirements of capturing small concentrations of carbon.

Exhibit 5: Carbon Concentration in Different Capture Methods

Source: Bettenhausen, Craig. “The life-or-death race to improve carbon capture,” Chemical & Engineering News. https://cen.acs.org/environment/greenhouse-gases/capture-flue-gas-co2-emissions/99/i26. From Global CCS Institute and National Petroleum Council data.

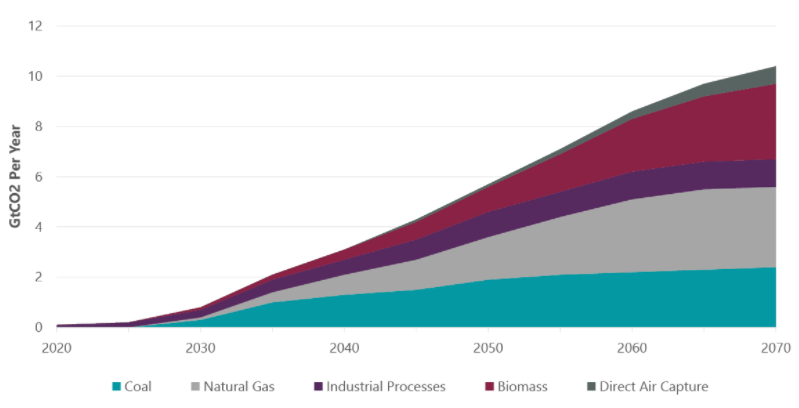

Despite the difficulty improving the economics of DAC, the challenge posed by continued global fossil fuel usage speaks to the need for its inclusion alongside other carbon capture technologies. The IEA’s sustainable development scenario posits a meaningful role for DAC (Exhibit 6).

Exhibit 6: Captured CO2 by Source in IEA Sustainable Development Scenario, 2020–2070

Source: IEA.7

Growing Policy Support for Carbon Capture

Governments and the private sector will drive the growth of carbon capture in tandem. In October 2021 the U.S. Department of Energy awarded $20 million to help states deploy carbon capture and storage. The Australian government is investing more than AUD$300 million over 10 years in the technology. The Norwegian government provided €1.7 billion in funding for the Northern Lights project, a pioneering joint project by Equinor, Shell and Total that aims to capture CO2 at industrial plants in the Oslofjord Region (cement and waste-to-energy), compress it and transport it by ship and pipeline for permanent storage in reservoirs 2,500–3,000 meters below the North Sea seabed.

The U.S. offers a tax credit for carbon sequestration under Section 45Q to incentivise investment in carbon capture projects. As of 2018, this tax credit covers both CO2 and carbon oxide and limits on the overall credits available in the market have been eliminated. For some types of taxpayers, the thresholds for the amount of carbon needed to be captured have been reduced. The 2021 Build Back Better (BBB) bill aimed to expand the 45Q tax credit by 70% — up to $85/ton. While the future of the BBB is uncertain, the 45Q tax credit enjoys a measure of bipartisan support in Congress. DAC projects also qualify for California’s Low Carbon Fuel Standard (LCFS) even if the project is located outside of the state of California.

Oil Majors and Industrial Gas Companies Have Expertise and Incentive, Smaller Innovators Have Technology and Focus

On the private side, oil majors are leading CCUS investments globally and carbon capture could be a critical part of how oil and gas companies navigate the energy transition. The main players are a combination of established energy and materials companies and a handful of innovative private companies with which they often partner. These include Carbon Engineering and Climeworks, the two leading DAC companies, from Canada and Switzerland, respectively — important names to watch in this emerging industry.

Among oil majors, Exxon, Chevron and Total are leaders in carbon capture. Exxon has current carbon capture and storage facilities in Wyoming, able to capture seven million metric tons of CO2 a year; Qatar, where it partners with Qatar Petroleum, able to capture 2.1 million metric tons a year; and Australia, where it partners with Chevron and Shell on the Gorgon CCS system, able to capture four million metric tons a year. Exxon also has a proposed carbon capture hub in the Houston industrial area, where the company estimates full implementation would store 100 million metric tons of CO2 a year by 2040 (as much as taking one of every 12 U.S. cars off the road — or roughly 22 million passenger cars)8, as well as in Canada, the Netherlands, Belgium, Scotland, Singapore and France.

The Gorgon CCS system in Australia is led by Chevron and transports and injects CO2 from the company’s liquified natural gas facilities into a sandstone formation two kilometers below Barrow Island where it is permanently stored. The project is still scaling up, but its annual capacity of CO2 storage is the equivalent of taking one million passenger cars off the road each year.

Occidental Petroleum is another integrated oil company making advances in carbon capture. Its subsidiary Oxy Low Carbon Ventures is partnering with Cemvita Factory, a Houston-based company that has developed a photosynthesis-based process that enables it to take CO2 from any source and convert it into a wide array of products. The project will convert CO2 into bioethylene, which Occidental affiliate OxyChem can use as a feedstock in its production of various plastics, such as foams and PVC pipes. Oxy Low Carbon Ventures is also working, through its subsidiary 1PointFive and in partnership with Carbon Engineering, on a large-scale commercial DAC facility in Texas.

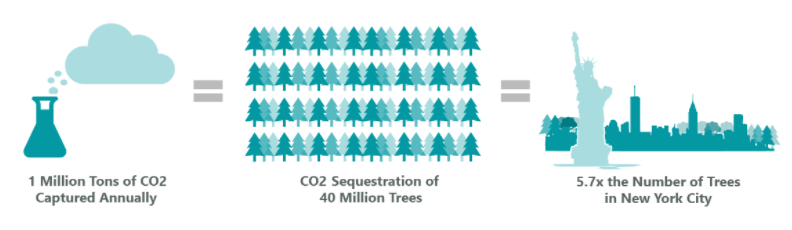

For its part, Carbon Engineering is also working with Storegga, an independent carbon reduction and removal company, on a DAC facility in Scotland designed to remove between 0.5 million and 1.0 million tons of CO2 from the atmosphere annually. Removing one million tons of CO2 is equivalent to the CO2 removal power of 40 million trees.

The prevalence of small, innovative companies in the early stages of carbon capture development gives some indication of the variety of players that could be attracting investor attention in the coming decades as the technology scales up.

Industrial gas companies such as Air Products and Chemicals (APD), Linde and Air Liquide have also been key in developing carbon capture technology, and importantly in lowering its associated costs, and will likely continue to play important roles in its growth.

- APD has two large-scale carbon capture systems in place at its Valero Refinery in Port Arthur, Texas, which were milestones in 2013 when they began and have captured one million metric tons of CO2 per year for use in enhanced oil recovery operations.

- Linde offers carbon capture solutions for industrial CO2 emitters such as power plants with either pre-combustion, oxyfuel combustion or post-combustion options.

- Among other projects, Air Liquide is partnering with TotalEnergies on a large-scale CCS facility in Normandy, France, helping tackle emissions in the Le Havre industrial zone. Some of the CO2 will be transported and stored by the Northern Lights project.

The Economics of Carbon Capture

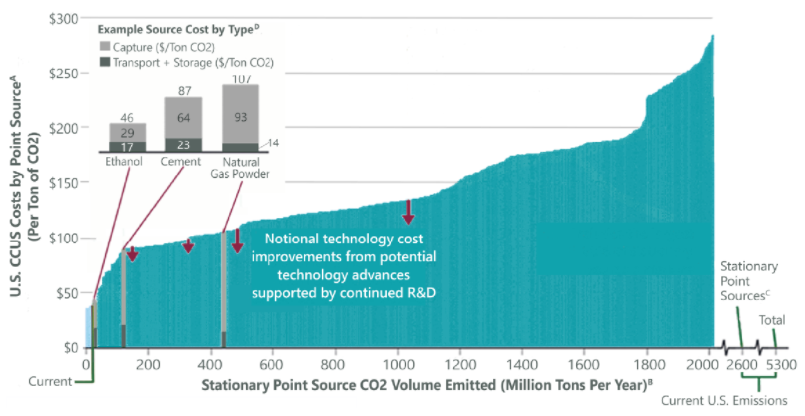

Costs and the need for incentives are the largest barriers to broad adoption of CCUS and DAC. On the stationary capture side of the market, which comprises around half of U.S. CO2 emissions, a December 2019 report from the National Petroleum Council suggested that at $100/ton price of carbon, it could be economic to capture and store as much as 8.5% of U.S. CO2 emissions (~450 million tons).9 However, considering the U.S. does not currently have a consistent CO2 pricing mechanism, the 45Q tax credit expansion discussed above is needed to enable the emergence of this industry. As carbon capture scales up, we would expect to see significant cost reductions over time (Exhibit 7).

Exhibit 7: Cost Curve for CCUS for Largest 80% of U.S. Stationary Sources

Cost Curve Notes:

Assumptions: Asset Life: 20 years; Internal Rate of Return: 12%; Equity Financing: 100%; Inflation Rate: 2.5%; Federal Tax Rate: 21%.

A. Includes project capture costs, transportation costs to defined use or storage location, and use/storage costs; does not include direct air capture.

B. This curve is built from bars each of which represents an individual point source with a width corresponding to the total CO2 emitted from that individual source.

C. Total point sources include ~600 Mtpa of point sources emissions without characterised CCUS costs.

D. Bar width is illustrative and not indicative of the volumes associated with each source.

Source: Meeting the Dual Challenge: A Roadmap to At-Scale Deployment of Carbon Capture, Use, and Storage. National Petroleum Council, 2019.

Oil majors with extensive operations in the U.S. Gulf Coast, together with the industrial gas companies, are particularly well-positioned to lead in this domain given the presence of existing infrastructure. Specifically, the U.S. has approximately 85% of the world’s CO2 pipeline mileage, with over 5,000 miles. The network is predominantly located in the Gulf Coast, as well as through the Permian Basin in Texas and New Mexico. CO2 currently transported through this network is a mix of anthropogenic and natural CO2 used primarily for enhanced oil recovery.10

The existence of this infrastructure is one of the key reasons that APD has announced a major investment to construct a $4.5 billion blue hydrogen production and distribution project in Eastern Louisiana — the world’s largest carbon capture and sequestration project. In addition to sales of blue hydrogen (hydrogen produced from natural gas with CCS) to customers in the Gulf Coast, APD expects to export part of the production to customers overseas for usage in decarbonising heavy transport.

As discussed above, the economics of DAC are more challenging than those of stationary CCUS. Climeworks is currently operating its demonstration scale Orca plant in Iceland, capturing 4,000 tons/year. Operating costs at the facility are estimated as high as $700–$900/ton, not to mention capital costs. However, costs are expected to fall meaningfully as Climeworks ramps up its larger 35k ton/year plant in 2023 and eventually moves to one million ton/year complex in 2028. At that scale, costs are expected to decline into the $100–$200/ton range.

Similarly, Carbon Engineering is operating a demonstration DAC plant in Canada. It is also developing a large-scale facility in Texas with 1PointFive that will capture one million tons of CO2 annually. Costs at the facility are not disclosed but we estimate the operating cost to be in the $200–$300/ton range. Carbon Engineering believes that with scale and replication, it can capture carbon at $100/ton.

Conclusion

Carbon capture technology has been controversial insofar as it enables fossil fuel–based energy and potentially distracts from efforts to move to a 100% renewable grid. Yet demand for fossil fuels could continue to grow for a decade or more (albeit at lower rates) and fossil fuels will remain a part of the energy ecosystem for a long time. As such, carbon capture can develop into a major global industry worth up to $1 trillion per year. We expect investors, activists, company management teams and policymakers to increasingly engage with this technology in the years ahead.

Related Perspectives

The Rising Case for Non-U.S. Equities

Massive fiscal reforms in Europe and resolution of the Russia-Ukraine war could help close the leadership gap between the U.S. and the rest of the world.

Read full article