International Does Heavy Lifting For a Change

Global Growth Strategy Commentary Q1 2025

Key Takeaways

-

Global equities outside the U.S. delivered strong gains in the first quarter as increasing policy uncertainty under the new Trump administration spurred investors to look overseas for more predictable returns.

-

While the Strategy underperformed the benchmark in a value-driven market, we were encouraged by our ability to mostly keep pace thanks to strong stock selection in consumer discretionary and financials.

-

Increased fiscal spending and focus on capital markets in Europe, Japan and China, prompted by a rapid remake of the global trade landscape, has increased the attractiveness of the non-U.S. regions we target to diversify our U.S. exposure.

Market Overview

Led by a sharp revival in Europe, global equities outside the U.S. delivered strong gains in the first quarter as increasing policy uncertainty under the new Trump administration spurred investors to look overseas for more predictable returns. The benchmark MSCI All Country World Index declined 1.96%, but in a reversal from the recent past, North America was the only region to experience significant losses and underperform. The United Kingdom and Europe Ex U.K. were by the far the strongest performers, while stocks in emerging markets, Asia Ex Japan and Japan also bested the index.

A stall in the mega cap growth trade, the chaotic introduction of tariffs accompanied by fears of a slowing economy and higher inflation sent U.S. stocks to their worst quarterly showing since the 2022 bear market. The S&P 500 Index declined 4.27% in U.S. dollars while the growth-laden NASDAQ Composite tumbled 10.42%. Trump’s actions to reorder global trade dominated headlines in his first three months in office, sending most U.S. growth indexes into correction territory. Tariffs were just one of the headwinds impacting the Magnificent Seven. The surprise emergence in January of DeepSeek, a Chinese large language model (LLM), with capabilities similar to the best LLMs but built at a lower cost, caused investors to question whether the massive capex being devoted to Gen AI would continue.

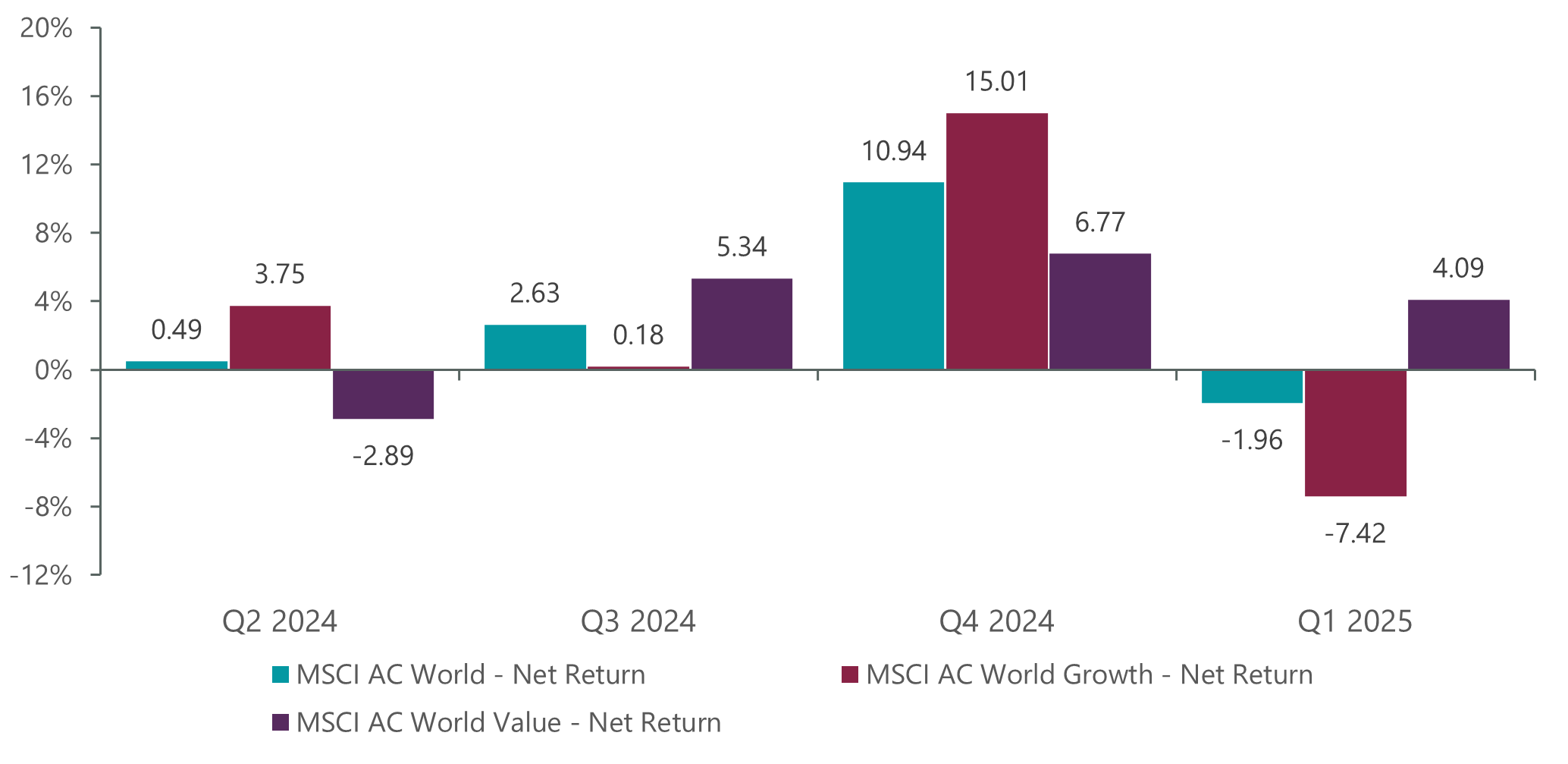

Pressured by this unwind of the generative AI trade, global growth stocks meaningfully underperformed their value counterparts with the MSCI ACWI Growth Index down 7.42% in USD compared to a gain of 4.09% for the MSCI ACWI Value Index. Growth’s underperformance of 1,151 basis points is the largest in the 25-year history of the indexes.

Exhibit 1: MSCI Growth vs. Value Performance

As of 31 March 2025. Source: FactSet.

The ClearBridge Global Growth Strategy underperformed the benchmark in the value-dominated quarter. While generally expected to lag in such one-sided markets, we were encouraged that the Strategy mostly kept pace. This despite our overweight to U.S. mega cap stocks.

Some might say the rally outside the U.S. was driven by necessity, as Trump’s aggressive and iconoclastic approach to global trade and foreign policy incited the European Union to action, although key policy leaders in Europe had been in discussion on the topic well beforehand. Global markets, including Europe, sold off sharply to start the second quarter after Trump unveiled a much wider and steeper than expected program of tariffs on all global trading partners, a situation expected to remain in flux in the near term.

As we detail in a new report on improving conditions for non-U.S. equities, Germany is leading a substantial increase in defense, infrastructure and overall fiscal spending as the Continent begins to shoulder greater responsibility for its security and economic growth. Performance has also been supported by easing price pressures, with inflation in the eurozone falling to 2.2% in March. Inflation in the region has now remained below 3% for 18 months, giving the European Central Bank greater latitude than the U.S. Federal Reserve in continuing to cut interest rates. The ECB has cut rates twice to start 2025 and, while growth has been tepid, the expansion is expected to remain intact.

Trump’s tariff actions have also sparked increased fiscal spending in China, with government officials billing generative AI as a key driver of the country’s economic growth and technology independence.

Improving sentiment toward the private sector helped push the MSCI China Index up 14.29% during the quarter.

From a regional standpoint, relative performance was hurt by negative stock selection in North America and Europe Ex-U.K., which offset the benefits of being more than 500 bps underweight the U.S. From a sector standpoint, stock selection in health care partially neutralised positive contributions from our consumer discretionary and financials holdings.

Within health care, Denmark’s Novo Nordisk, a leader in the blockbuster diabetes and obesity market, was hurt by the rise of compounding pharmacies taking advantage of the shortage of Ozempic in the market. The shortage, now over, and the company’s more aggressive approach to dealing with them should allow for better performance moving forward.

On the positive side, Chinese EV maker BYD was the top contributor as the new addition benefited from its leadership position in a home market experiencing multiple tailwinds. In communication services, U.S. wireless provider T-Mobile rose on a beat and raise quarter while Singapore’s e-commerce and gaming platform Sea Limited continued to execute well. Another bright spot was banks, with U.K.-based Lloyds, Spain’s Banco Bilbao Vizcaya Argentaria (BBVA) and Italy’s Intesa Sanpaolo all rerating more than 30%. A sector which was neglected for more than decade, investors are beginning to rediscover European banks for their sustainable earnings growth at some of the lowest valuations with highest capital distributions globally.

Portfolio Positioning

We added 11 new positions during the quarter while exiting 14 others. Trane Technologies, an Ireland-based HVAC supplier, was among our largest additions. Trane has a sharp customer value proposition in both replacement and new installations as its products have improved energy efficiency meaningfully in the past five years, bringing significant energy cost savings and quick, top-quality paybacks for replacing old equipment. Avoidance of fines and penalties for non-compliance with pending energy efficiency regulations in both the U.S. and Europe are a motivation for sales while the company’s data centre business is also growing at a rapid pace.

We also increased our financials exposure with the addition of U.S. money centre bank JPMorgan Chase, Japan’s Mitsubishi UFJ Financial and the repurchase of Dutch payments platform Adyen.

With tariff-induced disruptions to global trade, we believe risk management becomes more important than ever. One way we do this is through our valuation discipline. Among our largest exits was Canadian e-commerce enablement platform Shopify, which we sold due to rising tariff headwinds in North America. We sold audio streamer Spotify and luxury auto maker Ferrari meanwhile, after both newer names rapidly reached our price targets.

Outlook

International equities have long traded at a discount to their U.S. counterparts for fundamental reasons. Count among them a higher cost of capital, due to more stringent regulation, and less developed capital markets with which to fund the research and development in information and service industries. As part of Europe’s awakening to the reality of a changing global order, we believe these two areas will come into focus as drivers of further improvement and competitiveness. The current price for earnings growth disparity has created attractive growth opportunities for global investors seeking best-in-class substitutes for U.S. industry leaders, with the valuation disconnect most acute in the consumer sectors as well as financials.

Exhibit 2: Most Earnings Growth in Europe Comes Cheap

As of 31 March 2025. Source: Datastream, Goldman Sachs Global Investment Research.

We believe our active valuation approach to growth is well suited to leveraging a broadly improving global equity universe. Guided by our fundamental research, we can target best-in-class growth businesses at the most compelling prices across developed and emerging markets.

Fund flows are another metric we study closely to gauge investor sentiment. After suffering years of capital drain to the U.S. market, Europe and Japan are seeing positive flows again. This trend is encouraging and could provide the impetus to turn the current reactionary, anti-U.S. trades into a more permanent shift of capital to the overseas regions that augment our U.S. exposure.

Portfolio Highlights

During the first quarter, the ClearBridge Global Growth Strategy underperformed its MSCI ACWI benchmark. On an absolute basis, the Strategy delivered positive contributions across five of the nine sectors in which it was invested (out of 11 total), with the financials sector the main contributor and IT the primary detractor.

On a relative basis, overall stock selection contributed to performance but was offset by negative sector allocation effects. In particular, an overweight to the IT sector, a lack of exposure to the energy and utilities sectors and stock selection in the health care sector weighed on results. On the positive side, stock selection in consumer discretionary, financials, communication services and IT supported performance.

On a regional basis, stock selection in North America and Europe Ex U.K. detracted from performance while stock selection in Asia Ex Japan and emerging markets and an overweight to Europe Ex U.K. proved beneficial.

On an individual stock basis, the largest contributors to absolute returns in the quarter included BYD in the consumer discretionary sector, T-Mobile US and Sea Limited in communication services as well as Banco Bilbao Vizcaya Argentaria and Intercontinental Exchange in financials. The greatest detractors from absolute returns included positions in Nvidia, Apple and Broadcom in IT, Amazon.com in consumer discretionary and Alphabet in communication services.

In addition to the transactions mentioned above, the Strategy purchased shares of Costco and Coca-Cola in consumer staples, Tokyo Electron in IT as well as Prysmian and Siemens Energy in industrials. Exits included Adobe, Marvell Technology and Keyence in IT, Inditex and Asics in consumer discretionary, Uber and Bureau Veritas in industrials, Target in consumer staples, EQT AB in financials, Nippon Sanso in materials and Hoya in health care.

Related Perspectives

The Rising Case for Non-U.S. Equities

Massive fiscal reforms in Europe and resolution of the Russia-Ukraine war could help close the leadership gap between the U.S. and the rest of the world.

Read full article