Infrastructure's Defensiveness Shines as Equities Unwind

Q1 2025 Global Infrastructure Income Strategy Commentary

Key Takeaways

-

Infrastructure delivered positive returns in the first quarter, outpacing both global equities and U.S. equities, which were weaker amid higher policy uncertainty, specifically around tariffs.

-

Infrastructure’s defensive nature was rewarded in this environment, with regulated utilities leading returns, in particular in Europe and North America.

-

Trump’s policy agenda has so far been more disruptive than expected, and we anticipate uncertainty will weigh on U.S. growth. However, other regions such as Europe may see improving growth through a potentially constructive fiscal agenda.

Market Overview

Infrastructure delivered positive returns in the first quarter, outpacing both global equities and U.S. equities, which were weaker amid higher policy uncertainty, specifically around tariffs. The AI trade, which worked well throughout 2024, continued to unwind following concerns around China’s DeepSeek AI model representing a cheaper alternative to U.S. models.

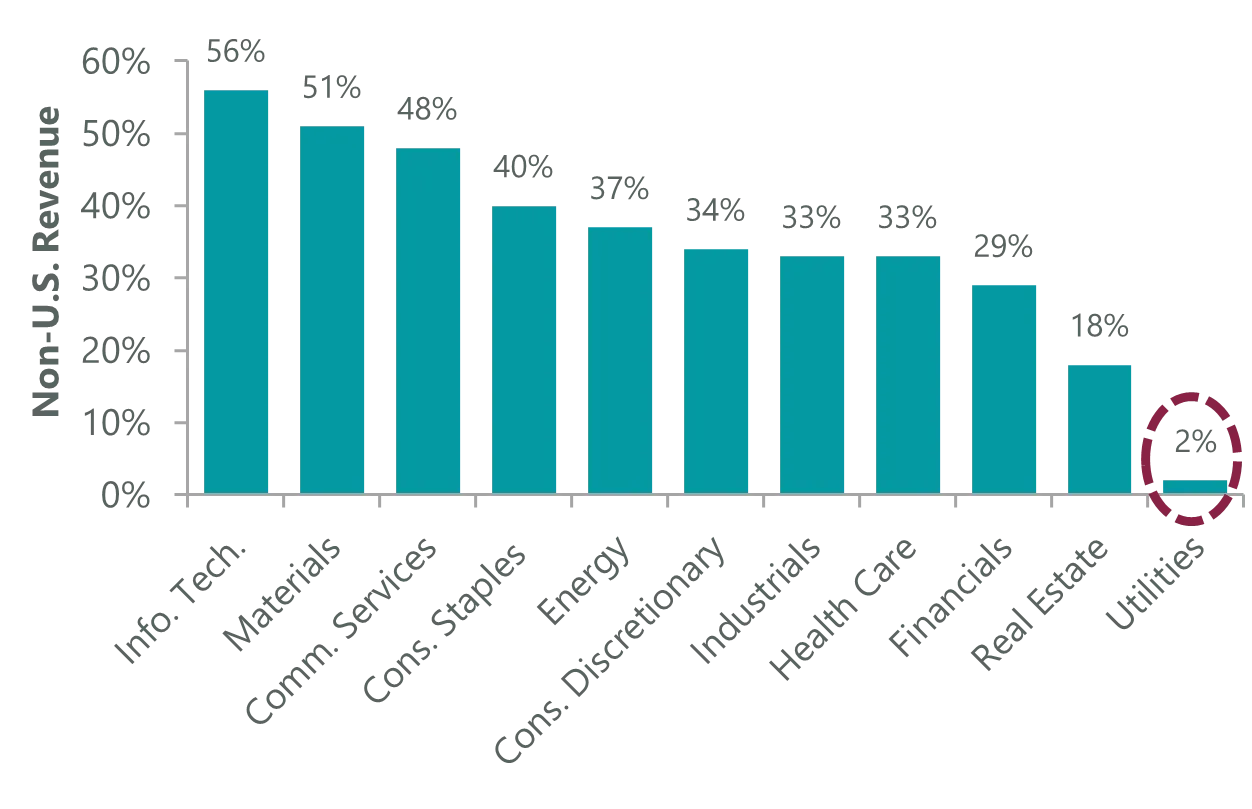

Infrastructure’s defensive nature was rewarded in this environment, with regulated utilities leading returns, in particular in Europe and North America. The Strategy in particular has benefited as tariff fears have taken hold as the largest weight in our infrastructure portfolios is to regulated utilities, which are notable for their lack of exposure to international trade, as utilities businesses are for the most part locally regulated entities delivering essential services (Exhibit 1). Regulated utilities actually may benefit in that their capital expenditures involve a high component of imported products, from steel to copper to transformers. Should these items increase in price due to tariffs, this will increase the utilities’ asset base and therefore their earnings, assuming steady allowed returns from regulators.

Tariff fears have also been exacerbated by signs of slowing growth, raising recession concerns. Accordingly, bond yields have notably come down in 2025. This has been a boon to rate-sensitive communication towers, as well as renewables, which, while negative overall for the quarter, saw some improvement.

Exhibit 1: S&P 500 Sectors and Non-U.S. Revenue

As of 28 February 2025. Source: FactSet.

On the other side of tariff and recession fears, North American rails were weaker, as they are more GDP sensitive, while European airports and toll roads outperformed on optimism around the German fiscal stimulus package spurring growth.

On a regional basis, Western Europe was the top contributor to Strategy outperformance for the quarter, with German electric utility E.ON the lead performer. E.ON runs one of the world’s largest investor-owned electric utility service providers and is the largest distribution system operator in Germany. Across Europe, it has 47 million customers. The Germany Infrastructure Fund bodes well for the investment environment across the nation’s electricity network, of which E.ON is a beneficiary.

Turning to North America, U.S. electric utility Entergy also performed well. Entergy is a pure regulated electric utility, providing services to approximately three million people in Arkansas, Louisiana, Texas and Mississippi. Entergy’s share price rose on the back of another guidance upgrade.

Canadian energy infrastructure company Gibson Energy and U.S. renewables utility XPLR Infrastructure were the largest detractors.

Gibson Energy is an oil midstream logistics provider in Western Canada and the U.S. We exited our position in Gibson as the company has lost key leadership personnel whom we regarded highly. The company’s longer-term growth aspirations under the newly appointed CEO also involve an M&A growth strategy outside their traditional liquids storage business.

XPLR Infrastructure LP, formerly NextEra Energy Partners LP, is a growth-oriented contracted renewables company formed by its sponsor and general partner NextEra Energy (NEE) to own, operate and acquire contracted renewable energy generation assets located in North America. The company’s share price fell due to a capital restructuring that was viewed as disappointing by the market. We exited our position

Outlook

Our outlook is for slowing global growth in 2025 with some regional nuances. Trump’s policy agenda has so far been more disruptive than expected, and we anticipate uncertainty will weigh on U.S. growth. However, other regions such as Europe may see improving growth through a potentially constructive fiscal agenda across the region. We remain somewhat defensively positioned toward utilities, which we see as undervalued at present, as peak bond yields have resulted in multiples coming down in that space. Utilities themselves have very fundamentally strong growth profiles, particularly in the U.S., driven by AI data centre power demand, industry decarbonisation and resiliency spending. European utilities are getting more capex approved by regulators and are seeing returns tick up as well, providing robust long-term visibility in earnings growth. Hence, we would expect earnings across infrastructure and utilities to remain robust despite the higher levels of uncertainty throughout 2025, with infrastructure’s defensiveness offering further upside.

Portfolio Highlights

We believe an absolute return, inflation-linked benchmark is the most appropriate primary measure against which to evaluate the long-term performance of our infrastructure strategies. The approach ensures the focus of portfolio construction remains on delivering consistent absolute real returns over the long term.

On an absolute basis, the Strategy saw positive contributions from eight of nine sectors in which it was invested in the quarter, with electric and gas utility sectors the top contributors and renewables the sole detractor.

Relative to the S&P Global Infrastructure Index the Strategy outperformed in the first quarter, driven primarily by stock selection in the electric, gas and toll roads sectors as well as an overweight to water utilities. Stock selection in water utilities detracted, meanwhile, as did stock selection in the energy infrastructure sector and an overweight to renewables.

On an individual stock basis, the top contributors to absolute returns in the quarter were E.On, Entergy, Redeia, Emera and Crown Castle. The main detractors were XPLR Infrastructure LP, Pennon, Gibson Energy, Aeroports De Paris and Fraport.

During the quarter, we initiated positions in U.K. electric utility SSE and U.S. electric utility Public Services Enterprise Group. We also exited our positions in U.S. communications company American Tower and U.S. electric utility Eversource Energy.

Related Perspectives

Infrastructure Poised to Mostly Weather Tariff Storm

A new regime of tariffs will likely create the need for more infrastructure to support reshoring, while utilities' lack of exposure to international trade may bolster their defensiveness.

Read full article