Midyear Equity Outlook: Rotation Seems Inevitable

Key Takeaways

- The equity market appears fatigued despite continued index strength as leadership has narrowed, setting up a likely period of elevated volatility in the near term due to bifurcated sentiment and fears of a slowing economy.

- While second-half profit expectations are likely to be reduced, we believe weakness will be contained, and the U.S. economy will avoid a recession.

- Longer term, we believe market breadth will return to healthier levels as mega cap concentration stagnates and participation broadens out to include more sectors well as greater contributions from small and mid cap companies.

- Earnings and stock performance from the Magnificent Seven should continue to normalise from the robust levels of the past 12–18 months with the cohort delivering solid, rather than spectacular, results going forward.

A Market in Transition

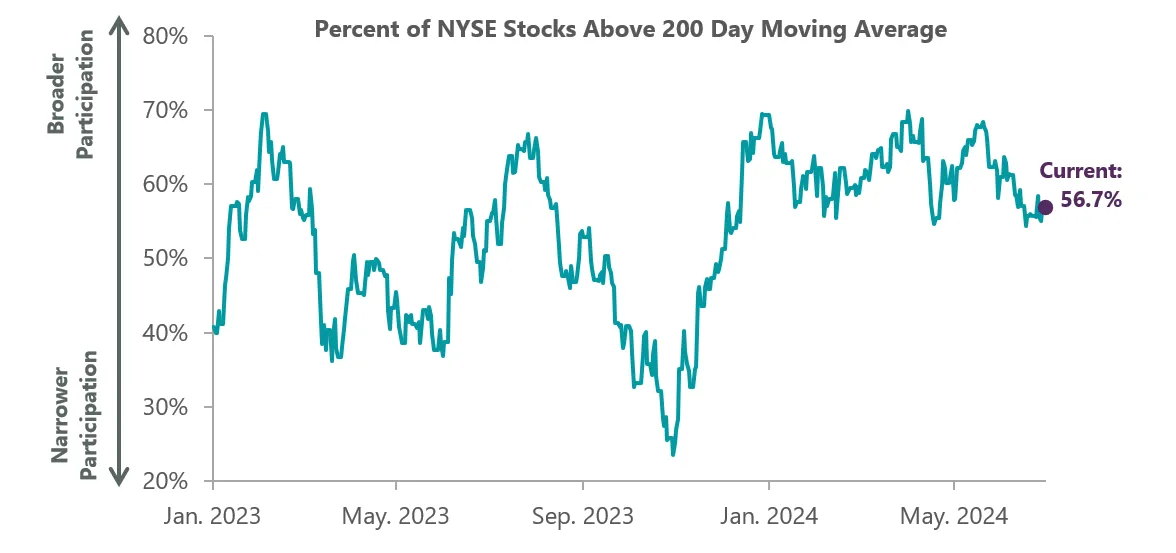

U.S. equities delivered outstanding performance in the first half of the year, with the S&P 500 Index up 15.3%, as solid earnings results and fiscal stimulus continued to offset the impact of elevated interest rates. Yet the headline performance numbers, buoyed by a resurgence in mega cap stocks and, more specifically, semiconductor leadership, have masked recent signs of deterioration below the surface (Exhibit 1).

The number of NYSE stocks making new highs peaked two months ago. Since then, we’ve seen a narrowing of participation across sectors as small and mid cap stocks have struggled for direction. Despite the S&P 500 rising 4.3% in the second quarter, six of the 11 GICS sectors declined in absolute terms, including shares of materials, industrials, energy and financials stocks, which we view as key barometers of economic activity. Given the powerful rally off the October 2023 lows, combined with current pockets of economic softness, a period of digestion or even a mild market correction would be a healthy long-term development, in our view.

Exhibit 1: U.S. Equity Market Breadth

Data as of 30 June 2024. Source: NYSE and Bloomberg.

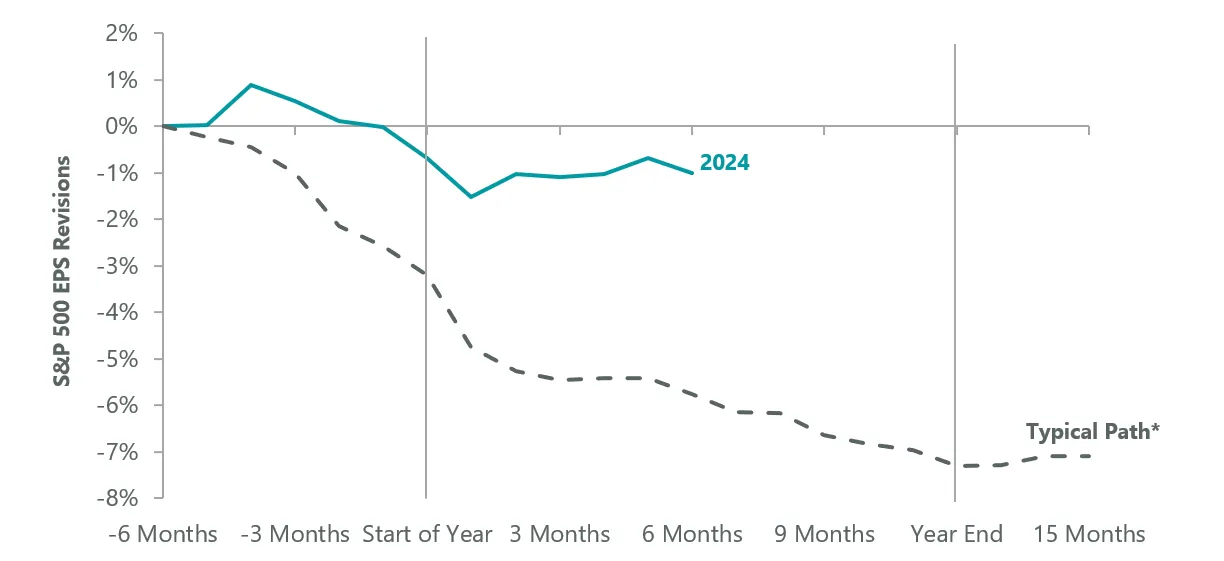

Year to date, profit forecasts have been steadfast with downward revisions quite minor. For the full year, consensus is looking for 10%–11% profit growth for S&P 500 companies. Nevertheless, for the first time since the Fed started raising rates, we’re beginning to see more meaningful signs that the economy is starting to weaken. Deteriorating employment and manufacturing data as well as other consumer-related spending trends all point to a slowdown. While we believe that economic momentum will continue through 2024, in part due to fiscal spending ahead of the election, we expect 2025 growth estimates to come down meaningfully. Current forecasts project 14% S&P 500 profit growth in 2025 but we believe that mid-single-digit growth is more likely. Importantly, we still expect economic growth next year.

Exhibit 2: EPS Revisions Resilient

*Typical Path is 2012-2017, 2019, and 2022-2023; 2018 is excluded due to TCJA (Tax Cuts and Jobs Act) distortion; 2020-2021 is excluded due to COVID-19 pandemic distortion; Percent change in $ EPS expectations. Data as of 30 June 2024. Sources: FactSet, S&P.

Over the course of the next three to six months, we believe the market will become increasingly concerned over corporate earnings but that ultimately the economy will expand and expectations will adjust appropriately, especially in light of the likelihood of lower short-term interest rates.

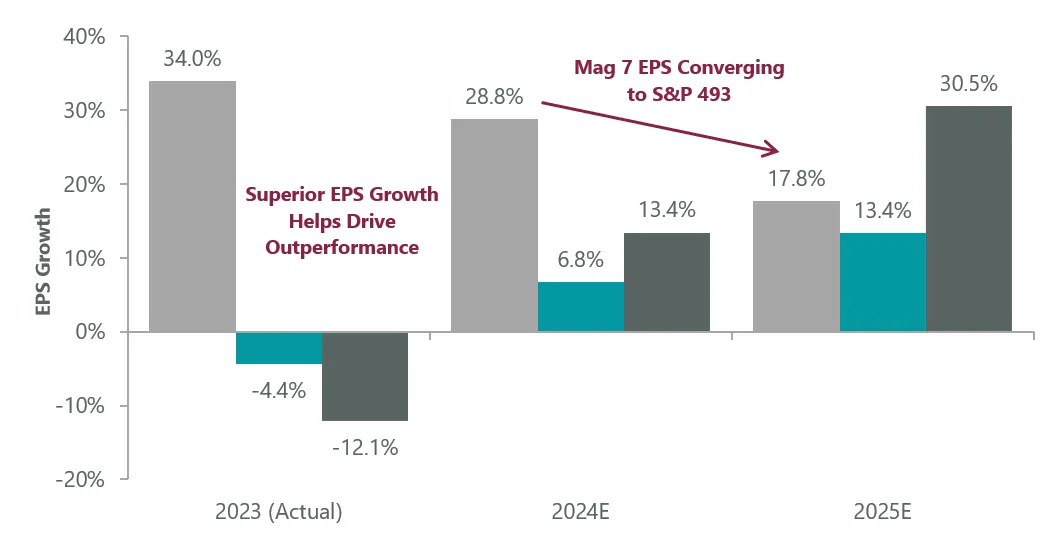

Market Concentration Impact

While the Magnificent Seven have disproportionately driven earnings growth the past two years, we expect a rebound in earnings among small cap stocks over the next 12– 18 months. Small cap companies have borne the brunt of higher rates. In 2023, profits for Russell 2000 companies were down 12%. This year, they are up 13.6% and are projected to jump to 31% in 2025. If this plays out, it should lead to a broadening of the market that we believe represents an opportunity for active managers.

Exhibit 3: Mag 7 Advantage Dissipating

Magnificent 7 data refers to the following set of stocks: Microsoft (MSFT), Amazon (AMZN), Meta (META), Apple (AAPL), Google parent Alphabet (GOOGL), Nvidia (NVDA), and Tesla (TSLA). Data as of 30 June 2024. Sources: FactSet, Russell, S&P.

The gains of the Magnificent Seven have caused market concentration to reach its highest levels since the 1970s. The top five stocks now account for 27% of the S&P 500 and the top 10 represent 37%. We believe that concentration is likely to stagnate near current levels as mega caps continue to deliver solid, albeit slower, earnings growth compared to the recent past. Already, we have witnessed more dispersion in performance among the largest stocks and we believe that diversified portfolios should start to outperform over the next 12–18 months.

Podcast

19 June 2024 | Midyear Equity and Economic Outlook: What the Internals Are Telling Us

CIO, Scott Glasser and Head of Economic and Market Strategy, Jeff Schulze see the economy slowing but avoiding recession in the second half of 2024 into 2025. Meanwhile, the equity market remains healthy yet bears watching due to deterioration beyond the mega caps. They also explain how these conditions create compelling opportunities for active managers.

Related Perspectives

U.S. Equity Outlook: Resilience to Keep Bull Market Intact

Capital spending and a resilient U.S. consumer are expected to sustain double-digit corporate profit growth in 2026, leading to positive yet more modest equity returns.

Read full article