The Challenge of Powering AI

Key Takeaways

- The accelerating pace of power demands among artificial intelligence aspirants is underappreciated and will involve a rising pull on already stretched energy resources.

- At some point the accelerating growth trajectory embedded in many of these AI beneficiaries could meet the more plodding and linear real-world reality, driving a major resetting of expectations.

- The shift toward higher power pricing is one of the most powerful fundamental tailwinds for capital-intensive cyclical stocks supporting the AI buildout, and one where the ultimate benefits are almost always underappreciated — creating an exploitable underreaction for value investors.

The Lifeblood of AI Infrastructure is Electricity

The market is focused on the transformative potential of artificial intelligence (AI) but, in our view, has not come fully to grips with the real-world bottlenecks attached to this emerging technology. While markets appear to be increasing the supply of leading-edge graphics processing units to meet accelerating demand, new pinch points have emerged as the AI arms race gains pace. These include sourcing data centre sites, lining up connections to the electrical grid and obtaining cooling equipment. While we believe markets will eventually find a solution to most of these impediments, the lifeblood of this AI infrastructure is electricity, and access to the electrical grid and power generation capacity will likely prove to be more durable headwinds.

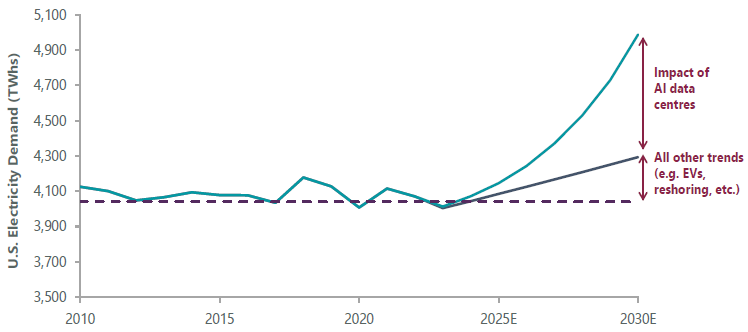

Innovations like cloud computing have been steadily increasing power demand from data centres, but current high-end estimates for electricity needed for AI computing is on the order of 30x more per server. Given the multitude of servers in a rack, racks in a data centre, and the growing number of data centres across the country, it is easy to see why the aggregate increase in power demand proves a headwind not only for the AI ecosystem but also for other users of electricity. As a result, current estimates conclude that the U.S. is poised to inflect to growth in power demand for the first time in decades at a pace of more than 3% over the next decade on the back of growing AI demand (Exhibit 1). Meeting this increased demand would be difficult under normal circumstances. That we are also undergoing and accelerating a global energy transition will make this even more difficult.

Exhibit 1: AI Driving a Sharp Increase in Power Demand

As of 21 March 2024. Source: Wells Fargo Securities, LLC.

This shift, from abundant yet polluting fossil fuels to renewables in the form of wind and solar, further complicates things. Namely, that the intermittent variability of day-to-day and seasonal swings in energy production make renewables poorly suited to flex up with current demand estimates. Furthermore, the buildout of these renewables also entails a monumental investment in electrical transmission infrastructure since the best places for wind and solar farms are often far from areas of high electricity demand. Ultimately, this will entail figuring out how to accelerate the connection of new resources to the grid, transmission buildouts and, we suspect, investment in “lesser evil” fossil fuels like natural gas to manage the intermittency risks to grid reliability.

Large AI Players Will Affect Power Pricing

Major AI infrastructure players Amazon, Google, Microsoft, Meta, and even increasingly Oracle, are not waiting, and appear poised to put existing systems to the test. Unsurprisingly, given these difficulties, power is rapidly emerging as the number-one bottleneck to more substantial AI data centre buildouts. Even if these companies can get all the permits and requisite equipment in place, lead times are rapidly lengthening for getting power hooked up. As such, many of these companies are circumventing the grid altogether by going directly to merchant power companies to purchase electricity via long-term contracts, often at a significant premium to prevailing power prices. We suspect that these deals will become more prevalent as these companies focus on speed, and that more deals are coming that will benefit power producers. While new renewable energy will have an important role to play, going directly to established power sources will both get data centers online faster and involve a rising pull on existing resources.

But what is good for large AI players does not necessarily translate into good for the rest of society. Take the recent deal with nuclear power producer Talen Energy and Amazon, in which Amazon has contracted to purchase upwards of 1 gigawatt (GW) of power at a 50% premium to prevailing power prices. This is a massive amount of electricity that instead of supporting grid reliability and keeping power prices low will instead serve Amazon alone.

A well-functioning market would have new additions offset this power draw from Amazon, but grid connection bottlenecks for this new power means that local grid operators have gone so far as to completely stop accepting applications due to the size of their backlog. Accelerating demand growth with insufficient offsetting supply means higher bills for consumers and businesses who will be asked to implicitly subsidise Amazon’s AI ambitions.

To make matters worse, the price required to match the supply curve for power — like any commodity — is not remotely linear (Exhibit 2). Once less expensive power generation resources are exhausted, the price required to bring a certain amount of power generation to bear starts to skyrocket around 130 GW as more costly “peaking” assets are asked to produce electricity during periods of peak demand — typically very hot or cold days.

While Amazon’s 1 GW deal might not seem like that much in comparison to that 130 GW, given this non-linearity, removing it from the system can have an inordinate impact on power pricing across the entire market, impacting tens of millions of people as grid operators anticipate peak winter load of ~135 GW. If demand in this market is 100 GW, removing 1 GW from supply has only a fractional impact on total power prices. However, at 135 GW, where the curve below starts to hitch meaningfully higher, it’s not hard to see a much more meaningful impact to market power prices.

Considering that all of Amazon’s competitors have certainly taken note of its ability to accelerate its AI strategy with the Talen transaction, it’s quite likely that others follow suit in this market, further tightening supply-demand. As a result, a parabolic increase in power prices is a real possibility over the next few years as this plays out.

Lastly, pulling that baseload off the grid will force utilities to lean more on renewables to support peak demand, creating the risk that they simply cannot support it, given their inability to substantially flex up production, unlike gas and coal plants. In a worst-case scenario, power blackouts are not out of the realm of possibility.

Exhibit 2: Price and Supply Is Not a Linear Relationship

Stylised PJM Dispatch Curve. As of 11 April 2024. Source: ClearBridge Investments

Any combination of meaningfully higher prices and decline in grid reliability likely drives meaningful political pushback to these AI builds. The AI aspirants will increasingly be told to pay their fair share rather than socialising the cost of data centres builds to consumers via higher prices. Big tech could also be put toward the back of the line for new grid connections given the lack of lasting localised economic development versus other alternatives like new factories. If so, at some point the accelerating growth trajectory embedded in many of those stocks could meet the more plodding and linear real-world reality, driving a major resetting of expectations.

Fortunately, this perfect storm of demand growth colliding with a historically no-growth power industry is being partially offset by the increase in the supply of U.S. natural gas during the shale era. A dominant and growing source of energy for U.S. power generation, shale energy extraction created an exponential increase in well productivity and helped drive supply growth that overwhelmed demand. Even with increasing gas demand, which should accelerate as power demand increases, natural gas prices are currently near all-time lows (Exhibit 3).

Exhibit 3: U.S. Natural Gas Prices Near Historic Lows

As of 4 April 2024. Source: Bloomberg.

AI Opportunities in Utilities, Energy

We believe the shift toward higher power pricing is one of the most powerful fundamental tailwinds for capital-intensive cyclical stocks, and one where the ultimate benefits are almost always underappreciated by investors — something that creates an exploitable underreaction for us as value investors. While mega cap developers and high-growth IT companies are receiving most of investors’ enthusiasm surrounding AI, this is also creating opportunities in sectors like utilities and energy that are no less compelling (albeit slightly less newsworthy).

Given expected power demand growth of potentially 3% or more, one of the greatest opportunities we see is in power providers within the utilities sector, as substantial investments in power generation and grid capacity become justified by higher power prices. Long-term expectations for pricing power on the back of greater electricity demand from AI development and implementation have propelled utilities companies Vistra and Constellation Energy higher in 2024 and look to continue as AI demand intensifies. Additionally, with large tech companies clamouring for greater renewable power sources, we believe renewables developer AES stands to be one of the greatest beneficiaries of sustained demand for both on- and off-grid power. While AES has not yet seen upward momentum on the back of this trend, we believe that project returns will increase, and growth could accelerate on renewables demand.

The most direct beneficiaries of a rebound in natural gas prices would be producers, which should see substantial long-term value creation opportunities as they become prime candidates to fill the need between growing power demand and power generation capabilities. Given the abundance of relatively cheap natural gas and its more environmentally friendly profile than other fossil fuels, producer EQT is poised to see significant growth not only through increased demand from existing power plants as they push their peak load capacity, but increased volume demand from the construction of new natural gas turbine and liquid natural gas (LNG) facilities in both the U.S. and abroad.

Conclusion

AI, like all forms of cognition, is power intensive and investors that are conditioned to think of digital innovation as purely deflationary may be in for a surprise. The path of least resistance is one of higher power prices in markets with outsize AI infrastructure builds. The difficulty of getting large-scale data centres powered may not be fully appreciated by investors and presents a risk to AI growth and the long-term outperformance of many AI-mania stocks.

Given generational market concentration in these names, we believe a substantial amount of market cap that has accrued to these stocks likely flows back into other parts of the market, flattering value portfolios with a size tilt away from mega caps and an awareness of opportunities in more capital-intensive, cyclical sectors.