The Rising Case for Non-U.S. Equities

Key Takeaways

- Massive fiscal reforms in Europe led by Germany, with an emphasis on increased defence and infrastructure spending, as well as the potential for lighter regulation could jumpstart earnings growth and equity valuations in the region.

- Settlement of the Russia-Ukraine conflict, less impactful U.S. tariffs on export-driven Europe and Japan and China’s support of its technology sectors to revive growth are all additional catalysts that could help close the equity performance gap between the U.S. and the rest of the world.

- We believe the momentum of improving sentiment as well as lower inflation levels in Europe, which provide greater flexibility for the ECB to lower interest rates, create a conducive environment for active non-U.S. equity managers.

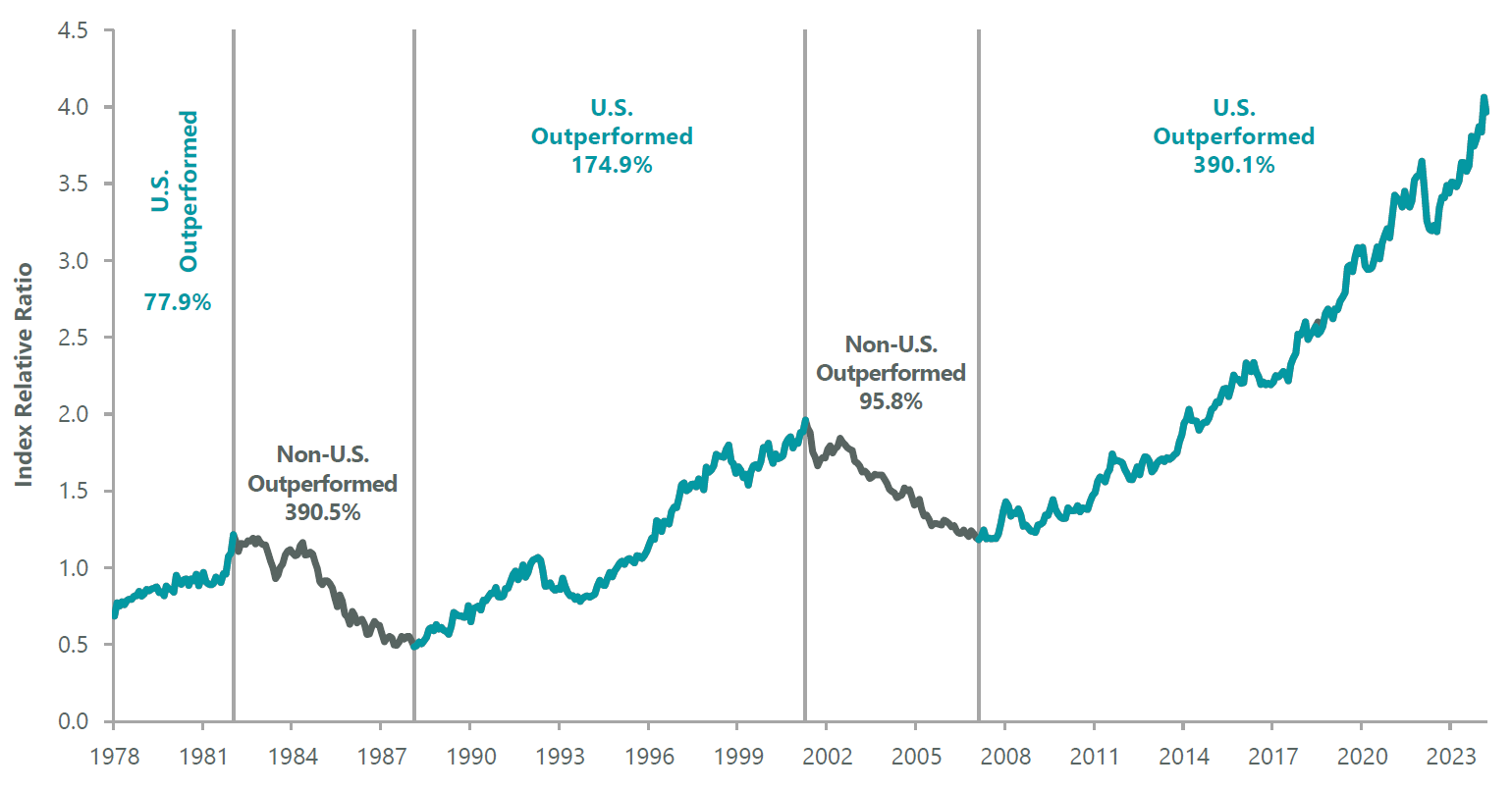

Non-U.S. developed market equities have defied conventional wisdom to start 2025, with the MSCI EAFE Index up over 10% through March 21 and outperforming the S&P 500 Index by over 1,300 basis points. After an 18-year period of mostly lagging non-U.S. performance versus the U.S. — the longest such drought going back to 1978 — it may be too early to call for a regional leadership rotation. But against the backdrop of rising U.S. tariffs, a potential global trade war and the seismic policy shifts they have sparked in Europe, the early results are encouraging.

Exhibit 1: Is Global Equity Leadership Poised for Reversion?

Note: S&P 500 (Total Return) vs. MSCI EAFE (Net Return). Data as of 31 December 2024. Sources: FactSet, S&P, MSCI.

One explanation for the recent non-U.S. equity resurgence is a rebound from oversold conditions. The MSCI EAFE Index (Europe, Australasia and the Far East) sold off following the U.S. presidential election but shares have snapped back in the first quarter, most meaningfully in Europe, led by strengthening currencies against the U.S. dollar. U.S. policy uncertainty toward traditional trading partners has seen fund flows into the U.S. reverse toward overseas markets. Overseas multiples, which had reached multidecade lows against the U.S., have moved higher this year but remain at a meaningful discount. Tariff risks may be less impactful to companies in Europe and the United Kingdom than headline U.S. revenues suggest, as many of these businesses generate a low level of U.S. imports and moved some of their manufacturing into the U.S. during the COVID-19 crisis. Companies in the MSCI Europe Index are expected to generate 26% of their revenues from the U.S. in 2025 but less than 7% are projected to be from good exports subject to tariffs, according to Morgan Stanley Research.

More importantly, as long-term investors with a three- to five-year time horizon, we believe the secular case for non-U.S. equity leadership is improving dramatically, and we see the emergence of more material tailwinds supporting non-U.S. stocks that have yet to manifest in higher multiples.

Exhibit 2: Non-U.S. Equities Trade at Historical Discount

Data as of 31 December 2024. Source: FactSet.

Europe Set Up for Earnings Growth

Without question, the biggest change between the end of 2024 and today is the arrival of significant fiscal stimulus for Europe. By becoming more aggressive with second-term tariff actions, including on multidecade allies , and by moving to back Russia in the Ukraine conflict, President Trump has succeeded in uniting Europe toward insulating itself from what appears to be withdrawal of support, primarily in defence, but potentially in other areas as well. A thoughtful paper drafted by Mario Draghi in September highlighted the historic issues Europe continues to have in generating growth.1 Combined with genuine fear of Russian aggression once again in Europe and the rise of the far-right party in the recent German elections, Germany instituted a meaningfully large defence and infrastructure package. More fiscal spending increases are expected in other markets as well.

Europe is preparing to stimulate its economy in a way it hasn’t done in a very long time. Having seen the benefits of stimulus acts in the U.S. (CHIPS, IRA etc.) and the job creation and growth they created, Europe will likely embark on something similar. The U.S., however, remains in fiscal contraction mode, something that will feed through into slowing GDP and, we believe, earnings and multiples as well.

In global asset allocators’ search for the best risk-adjusted returns, the U.S. is no longer the only option. Earnings growth is a precondition for any asset class working, with allocators optimally looking for the best earnings growth in the cheapest assets. We believe Europe now offers a better setup for earnings growth from depressed levels and scope for multiple expansion as more investors recognise the region’s potential. Improved earnings growth on its own may be enough to attract capital, but the combination of EPS growth and a rerating of multiples would be a powerful combination supporting returns. Fund flows back into China from Japan are another sign that consumption could be improving in another key region many allocators had previously cordoned off.

At the same time, the post-election U.S. equity market has become more momentum driven, with major swings based on the daily machinations of the new administration.

Russia-Ukraine Peace Should Spark Pro-Growth Reconstruction

Another pro-Europe catalyst would be an end to the Russia-Ukraine conflict, which could generate significant stimulus for the Continent overall as Ukraine would require some kind of 21st century Marshall Plan to revive its economy. The World Bank estimates that reconstruction costs could run as high as $480 billion, creating significant demand for cement and steel, benefiting companies in building and other materials sectors. An enormous amount of reconstruction will need to happen if and when the war finally does end that will also require industrials companies that manufacture heavy construction equipment and parts and build infrastructure. In addition, resolution of the conflict requisite with the resumption of some legacy natural gas supply from Russia could lower energy costs for European and U.K. businesses and consumers.

Meanwhile, a lasting peace could spur renewed Western involvement in Russia. The Russian equity market and economy have been in disinvestment mode for years, as the Ukrainian aggression led to significant European withdrawal from those markets. Estimates of those lost revenues run up to $60 billion. Could those return? We believe it’s a possibility that markets are not discounting.

Trump’s continued tough talk on Europe shouldering a larger NATO role have spurred defence spending increases across Germany, the U.K. and other European nations. EU leaders have highlighted the need to better integrate a fragmented European defence industry, standardising and streamlining military equipment development to achieve economies of scale and better operability across different national forces. Defence spending across European members of NATO is expected to increase by over $200 billion a year over the next five years and remain at those higher levels. In the East, Japan is also expected to provide for a greater share of its defence, relying on industrial conglomerates to boost production.

Germany Recognises Need for Greater Stimulus

A third potential driver for non-U.S. equities is increased fiscal stimulus in Germany and Japan, the world’s third- and fourth-largest economies, respectively. Both are well behind the U.S. in terms of fiscal spending. Political upheaval in Germany, which came to fruition with a record turnout in first-quarter elections, could remove past impediments to greater spending. The German parliament in mid-March approved a €500 billion infrastructure fund and lifted the debt brake on defence spending. Given the willingness of coalition partners to go along with these reforms, accommodative measures (which we believe could be implemented as early as the third quarter) could include total additional stimulus of around 2.5% of GDP, targeting increased spending on areas like the energy transition and semiconductors. Fiscal spending could rise as high as €1 trillion over the next five years. We view this shift in German politics as momentous, arguably on par with German reunification following the fall of the Iron Curtain.

These policy moves come amid growing urgency across the EU to take aggressive actions to keep the region competitive, both on macro and corporate levels. Draghi’s 2024 report on European competitiveness states that “to digitalise and decarbonise the economy and increase our defence capacity, the investment share in Europe will have to rise by around 5 percentage points of GDP to levels last seen in the 1960s and 70s. This is unprecedented: for comparison, the additional investments provided by the Marshall Plan between 1948-51 amounted to around 1-2% of GDP annually.”2 Policymakers have highlighted the need to lighten regulation to foster greater innovation and provide additional research and development support to keep more early-growth companies expanding in European markets rather than relocating to the U.S. With an aging workforce, productivity growth through innovation is essential to the region regaining its stature both among companies looking to invest capital and investors seeking attractive returns.

Japan Taking Steps to Improve Profitability, China Interesting Again

Japan, meanwhile, recently announced massive stimulus of ¥1.8 trillion to fund its energy transition. This comes on top of years of ongoing government reforms and more recent actions by the Tokyo Stock Exchange aimed at improving Japanese companies’ corporate governance and return on equity, encouraging greater domestic investment in Japanese equities as well as attracting more offshore investment capital to Japan. Spurred by the initiation of stock dividends and share buybacks as well as accretive M&A activity that has encouraged companies like Sony Group to divest non-core cross holdings, corporate profitability — a key driver of stock performance — has improved.

A final catalyst supportive of non-U.S. equities is the return of China as a compelling destination for investment. After a multiyear campaign of restrictive measures and crushing regulation of private enterprise, Beijing is showing signs of reversing course to support Chinese technology companies as a way to jumpstart GDP growth. Equity valuations became extremely depressed due to government intervention and have yet to rerate meaningfully in China’s anemic post-COVID recovery. After significantly reducing exposure in China over the last several years, we are coming around again to viewing the market as a fertile source of new ideas.

A Potentially Seismic Leadership Shift

From an equity return perspective, the S&P 500 Index has outpaced the MSCI ACWI ex-US Index by 295% cumulatively since 2010 and led in 13 of 15 years. This large performance differential has been partially a function of superior earnings growth, with the U.S. outearning the rest of the world by 143% over the same time frame (Exhibit 3). Like Japan, the EU is embracing reforms to enhance profitability. Those reforms, in conjunction with meaningfully higher spending on defence and infrastructure, are expected to boost EPS growth in Europe and could lead to a rerating of P/E multiples 10% to 15% higher, according to Citi Research.

Exhibit 3: Earnings Have Driven U.S. Leadership

NTM = Next 12 Months. Data as of 31 December 2024. Sources: FactSet, MSCI, S&P.

While the impact of broad, institutional actions to spur economic growth and capital market performance in non-U.S. markets can take years to appear, we believe the momentum of improving sentiment as well as lower inflation levels in Europe, which provide greater flexibility for the ECB to lower interest rates, create a conducive environment for active non-U.S. equity managers.

On a sector level, non-U.S. companies are growing their leadership positions in a wide range of industries that we are currently targeting across our strategies. These include biopharmaceutical, apparel and luxury goods makers in Europe; semiconductor equipment providers and contract manufacturers in Asia; as well as banks across developed and emerging markets that trade at inexpensive valuations not tied to any real fundamental issues. For example, European financials, consumer staples, consumer discretionary and health care stocks trade at historical discounts to their U.S. counterparts.

One caveat might be that innovation on average may be less prevalent across non-U.S. markets than in the tech-centric U.S. economy. As growth investors with a wide mandate that targets companies at various stages of maturity and profitability, however, we can lean on our fundamental research to identify businesses thriving on their merits.

Developed market valuations have barely budged in the last 20 years (compared to a 40% rise in U.S. multiples). However, we believe this low starting point, taken together with broader policy catalysts in a rapidly evolving geopolitical landscape, most notably in Europe, provides scope for a reversion in global equity leadership.

Related Perspectives

Global Value Improvers Strategy April Commentary

Despite market noise, there remain many durable themes, such as the energy transition and artificial intelligence deployment, that we will look to add to opportunistically.

Read full article