Transports Poised for Delayed Recovery

Key Takeaways

- An extended contraction in U.S. manufacturing activity has left the transports industry mired in a freight recession, yet the emergence of reshoring and improving operating efficiencies leave high-quality operators attractively positioned for an economic recovery.

- Less-than-truckload (LTL) companies benefit from higher barriers to entry and pricing discipline that should allow them to expand margins as volumes pick up.

- Commercial rail operators feature even stronger moats with opportunities to improve efficiency, service quality and pricing power.

Manufacturing Recovery Would Reinvigorate Trucking, Rails

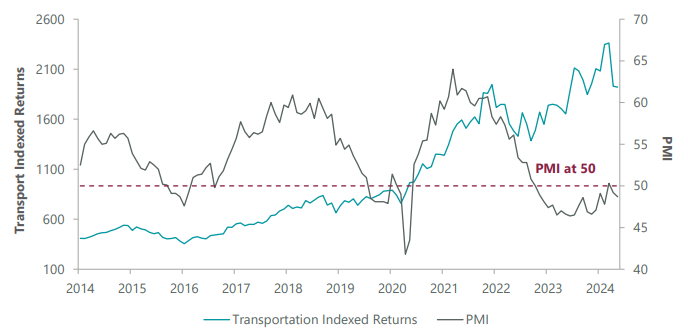

The last two years have seen a prolonged contraction in manufacturing activity, resulting in weaker volumes for companies that transport industrial goods on trucks and trains. The ISM Purchasing Managers Index, a measure of U.S. manufacturing activity, has a notable correlation with transport volumes, as it reflects the demand for raw materials, intermediate goods and finished products. A PMI reading above 50 in March, a level indicating expansion in industrial activity, was a rare bright spot that drove optimism about a potential freight recovery in 2024. However, PMI retreated below 50 in April and May and the New Orders Index has also been weak, with a May reading of 45. As a result, we believe a freight recovery has been pushed out but see the pullback in these stocks as a good opportunity to prepare for an eventual pickup in activity and freight volumes.

The macro outlook for the industry remains mixed. On the positive side, a good portion of industrial inventories have normalised, removing the headwinds caused by destocking. Additionally, while the replenishment of inventories or a pickup in end markets has yet to materialise, financial conditions for customers are expected to remain stable or improve as we head into the second half of 2024 and into 2025 (Exhibit 1).

Trucking and rails stocks have retraced directionally in line with PMI pulling back below 50, but they are well positioned for earnings growth when volumes improve. Despite near-term headwinds of overcapacity and cyclically weak demand, we believe the economy is due for a recovery and that secular growth drivers for transports, such as industrial nearshoring and reshoring, are still intact.

Exhibit 1: Transports Stocks Correlated with PMI

PMI is the Institute for Supply Management Manufacturing PMI. As of 31 May 2024. Source: Bloomberg, ClearBridge Investments.

Competitive Dynamics Separate LTL Operators

The trucking industry has been in a freight recession for over 20 months, and a recovery has been delayed. However, we believe there are some attractive segments within trucking, such as less than truckload (LTL), which have higher barriers to entry and more margin expansion potential than the more fragmented truckload segment.

LTL companies operate in a more niche market, where they consolidate smaller shipments from multiple customers and deliver them to different destinations. This requires more network density and terminal infrastructure — the larger carriers have roughly 250 to 300 terminals nationally. This real estate component serves as a moat and has led to a consolidated industry with 80% of market share among the top 10 operators. Such concentration also contributes to greater price discipline: in down markets, LTL prices tend to flatten rather than decline, while in up markets pricing steps up and contributes to operating margin expansion. This is unlike the highly fragmented truckload industry where there are no real estate requirements and pricing trends negatively in down markets, compressing margins.

Within the LTL segment, we view Old Dominion Freight Line and XPO Logistics as well-positioned operators. Old Dominion is a best-in-class player with industry leading service, management and margins. It also has the excess capacity to absorb volume growth when demand exceeds industry capacity, while maintaining a strong balance sheet to buy back stock in weaker markets. XPO has the opportunity to expand its margin by improving its service quality, which should enable stronger pricing through the cycle. The company recently hired an executive from Old Dominion who has strong operating experience and who has been implementing best practices to improve service quality. The broader LTL industry should also benefit from the 2023 bankruptcy of LTL provider Yellow, as it eliminated the lowest cost and least disciplined carrier in the industry and should enable stronger pricing for everyone else through the cycle.

Freight Rail Offers Cost Advantages

Commercial rail is another highly consolidated industry with high barriers to entry. These companies are effectively duopolies in each region with tremendous pricing power. While rail volumes are highly correlated with the macro environment, rail operators have opportunities to improve efficiency, service quality and pricing power through their continued expansion of precision scheduled railroading (PSR) to reduce costs, improve asset utilisation and increase network velocity. As rail companies become more reliable and consistent with delivery times, they also become more competitive with trucking, representing a share gain opportunity. Rails also offer 4x more fuel efficient transportation than trucking, which helps customers make progress on their emissions targets.

Within the rail segment, we see an attractive opportunity for earnings improvement at Union Pacific (UNP). The company has a relatively new CEO, Jim Vena, who is driving network efficiencies and margin improvement. When economic activity inflects higher, a company like Union Pacific can flex both strong operating leverage and stronger pricing. The company also stands to benefit from reshoring trends, as does Canadian Pacific Kansas City, which has the only contiguous rail network running from Canada through the U.S. into Mexico operated by a single company. Canadian Pacific also maintains the market leading position in transporting goods to and from Mexico via rail.

Freight Rail Offers Cost Advantages

With a sluggish economy and expectations being so low, we believe transport stocks with the most attractive competitive dynamics are set up very well for a cyclical recovery. Starting from significantly below normalised volume growth, and with capex being spent on reshoring projects, a rebound in economic activity plus secular tailwinds provide bullish conditions for higher-quality LTL and rail companies.

Transports A Value Play

With a sluggish economy and expectations being so low, we believe transport stocks with the most attractive competitive dynamics are set up very well for a cyclical recovery. Starting from significantly below normalised volume growth, and with capex being spent on reshoring projects, a rebound in economic activity plus secular tailwinds provide bullish conditions for higher-quality LTL and rail companies.

Related Perspectives

Global Value Improvers Strategy February Commentary

Politics and trade concerns remained centre stage in February, as discussions and negotiations around tariffs by the new U.S. administration and retaliatory tariffs by trade partners weighed on global markets, driving value to outperform growth stocks.

Read full article